Warehouse costs as % of salesTransportation costs as % of salesFinished goods inventory turnsRaw materials inventory turnsInventory obsolescenceWork in progress daysFinished goods days

Raw material daysInbound delivery in fullInbound delivery on timeOutbound delivery in fullOutbound delivery on timeManufacturing cycle time

The Three-Level Hierarchy

A three-tier KPI solution is a little more involved, with the top two tiers comprising end-to-end supply chain metrics with Tier 2 being more granular than Tier 1.

Meanwhile, the third tier can include KPIs that show performance at a functional level, and highlight how each function’s primary activities are contributing to end-to-end performance.

Whether you choose a two or three-tier system will depend on the specifics of your company’s business, the company’s size, and other similar factors.

Of course, it’s also possible to add further tiers for even more granularity, but again, the more levels you have, the more complex your KPI solution.

Now let’s get a little more granular in this study of supply chain KPIs, and look at some of the specifics involved in tracking cross-functional and functional performance.

Cross-Functional and Functional KPIs: How to Apply the Right Ones

Functional KPIs offer value, of course, but when you combine and integrate them to offer an end-to-end view of performance trends, you can magnify that value considerably.

It can be helpful, therefore, to identify the processes involved in your supply chain before deciding upon the functional-specific measures that collectively, will show how these processes are performing.

You can identify and categorize your company’s processes in any way that suits you.

Still, it’s worth briefly discussing, as an example, one of the process cycles commonly used when monitoring supply chain performance.

That cycle typically goes under the heading of order-to-cash.

Order to Cash

Order to Cash (OTC) is the end-to-end process involved in capturing and fulfilling a customer’s order, and can be measured using a carefully coordinated range of functional KPIs.

The OTC cycle loosely comprises the following sub-processes:

Customer-order captureOrder picking and packingDispatching, shipping, and delivering the orderBilling the customerReceiving and recording the customer’s payment

OTC is a process that illustrates clearly, how the supply chain comprises a broader range of business functions than you might have thought.

For example, the sales function is not typically seen as part of the supply chain, but if your sales team captures orders from your customers, the first step in the supply chain is very much sales-related.

Similarly, it’s easy to forget that a supply chain comprises the flow of information and money, as well as goods.

That necessarily implies a need for financial functions to be measured if you want a full picture of end-to-end supply chain performance.

Who’s Involved in Order to Cash Measurement?

When you measure the order-to-cash cycle, you will need to set appropriate KPIs for your sales department, warehousing and transportation functions, and for some areas of finance, such as accounts receivable.

To illustrate how much this matters, consider the possible consequences of any failure or delay in recording a customer’s payment.

Let's assume a system or process issue that results in the delayed posting of the customer's payment.

If the customer makes frequent purchases, receipt of payment for the previous delivery might not be recorded before the customer places a fresh order.

Because there is no record of payment, the customer's account might be put on hold in your ERP system, and the whole process of supplying that customer stops until somebody spots the problem and resolves it.

That’s a supply chain performance issue, just as much as if your warehouse team fails to pick the order.

Functional KPIs in OTC

If you’re beginning to think that order-to-cash cycle measurement sounds incredibly complicated, you can relax a little, because it need not be that hard.

For one thing, a made-to-measure (see what I did there?) KPI exists that’s relevant to pretty much any type of supply chain operation.

It’s a composite KPI called

perfect order, and it incorporates functional measurements for all stages of the OTC process.

You can use the perfect order KPI to track OTC performance, by breaking it into its components and applying the metrics as relevant to the different functions in your supply chain.

The breakdown should look something like this:

Sales function: Percentage of orders captured accurately (reliant on customer feedback)Warehouse function: Percentage of orders picked in fullTransport function: Percentage of orders delivered in full; Percentage of on-time deliveriesFinance function: Percentage of orders billed correctlyAll functions: Percentage of orders with correct and accurate documentation

The functional KPIs mentioned above are the highest level of metrics that you will use.

They will likely need breaking down further to maximize identification of performance issues and aid in solution planning—always remembering to keep things simple by only holding people responsible for the KPIs they can directly affect.

For instance, in the warehouse, the percentage of orders picked in full might be broken down into…

Percentage of orders picked with errors – incorrect quantityPercentage of orders picked with errors – incorrect productPercentage of order lines picked with errors - incorrect quantityPercentage of order lines picked with errors - incorrect product

At this level of granularity, the picking-performance measurement will allow you to see trends and patterns in picking accuracy.

You might notice, for example, that a significant number of orders are picked with minor errors, or that a small number of orders contains many errors.

Furthermore, by applying codes to highlight the exact nature of each error, you will gain an even higher level of visibility.

You might notice, for instance, that a particular product is affected more than others by picking errors, and then determine if the problem lies with that product's markings, labels, storage location, or proximity to a similar product in the slotting plan.

What Makes an Effective KPI Suite?

Earlier, I mentioned that the SMART acronym might be a little too simple to use as a standard for developing KPIs.

As a more practical guide, you might wish to apply the following list of golden rules when building up a suite of logistics KPIs for your company:

1) Make sure you align all KPIs with the overall business objectives of your company.

2) Ensure that each KPI has an “owner”, whether that is an individual or a group of people.

3) Design each KPI as a leading metric, able to assist with the prediction of performance issues.

4) KPIs should be actionable, providing timely, accurate data that owners can interpret and utilise.

5) Each KPI should be easy for its owners to understand.

6) Each KPI should reinforce and/or balance others.

7) No KPI should contradict or undermine the others.

8) Each KPI should have a target or threshold indicating a minimum-acceptable level of performance.

9) As each KPI is proved stable and effective, it should be reinforced by incentives or compensation.

10) Each KPI should be update-able, as they will lose relevance over time.

The one caveat I would add here, concerning golden rule #9, is that it’s essential to incentivise only behaviours that do not jeopardise health and safety or regulatory compliance, or otherwise put the reputation of your business at risk.

Success With Supply Chain KPIs: A Brief Case Study

In the early years of this century, a British division of a global brewing company decided to diversify into contract distribution to increase utilization and reduce costs across its national warehousing and logistics operation.

The company’s customers mainly comprised pubs and restaurants, which were either under individual ownership, or owned by the brewing company.

However, the traditional model for licensed alcohol sales was undergoing a transformation, with most of the major brewers disposing of their estates following freshly introduced laws, implemented to curb what was seen by the government as a barrier to fair competition in the industry.

As a result of these changes, several large pub companies sprang up, and the brewing company (the subject of this study) determined to sell distribution services to these entities.

It won a porterage contract with one of the largest pubcos and suddenly found itself with one customer that represented more than 50% of its business revenue.

Threats and Measures: A Catalyst for Change

It wasn’t long before problems arose, with the customer threatening to exit the contract under a service-level clause.

Fortunately, the pubco’s director was an ex-logistics guy who proposed an alternative solution.

The customer and the supplier would work together to develop KPIs that would highlight why many pubs were receiving deliveries with incorrect product quantities, and why even more deliveries were arriving late.

The partners developed a KPI portfolio, which, although hardly simple in the way this article advocates, served to highlight some severe issues in the supplier’s warehouse and transportation functions.

The list of KPIs included delivery on-time and in-full (DIFOT).

The in-full KPI was broken down into factors such as:

Need Further Assistance?

Here at Logistics Bureau we have 20 years of experience in assisting clients with Supply Chain Benchmarking, and the development of suitable KPIs.

We have benchmarked almost 1,000 Supply Chains! We can help you:

Select the right KPIsFor the right level of managementSet the right targets for those KPIsAnd assess your current performance

Some More KPI Related Pages:

At Benchmarking Success.

Online KPIs

And on this site:

What is a KPI?Free Report on KPIsKPIs and Benchmarking

Have you seen our latest Supply Chain Benchmarking promotion? Go to this page: https://www.logisticsbureau.com/supplychainbenchmarker/

Want a 25 page KPI report for your industry?

To see if you are leading the pack or falling behind, you can buy the report instantly

here.

The download comes with many added bonuses as well.

Editor's Note: We first published this post in May 2013.

It has since been revamped and updated with more comprehensive information.

The most recent updates were made in September 2019.

Key Performance Indicators (KPIs) in Power Pivot

Key performance indicators (KPIs) are visual measures of performance.

Based on a specific calculated field, a KPI is designed to help users quickly evaluate the current value and status of a metric against a defined target.

The KPI gauges the performance of the value, defined by a Base measure (also known as a calculated field in Power Pivot in Excel 2013), against a Target value, also defined by a measure or by an absolute value.

If your model has no measures, see

Create a measure.

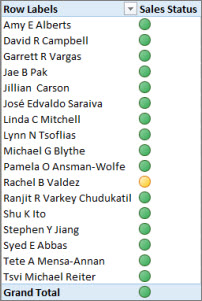

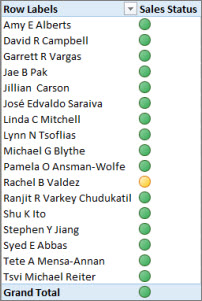

PivotTable with Employee Full Name in rows and Sales KPI in values

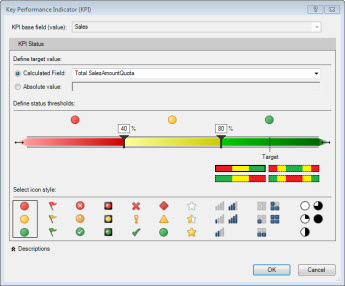

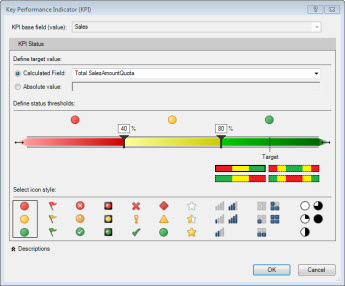

Create a KPI

In Data View, click the table that has the measure that will serve as the Base measure.

If you have not already created a base measure, see

Create a measure.

Make sure the Calculation Area is displayed.

If it is not showing, in Power Pivot, click

Home>

Calculation Area.

The Calculation Area appears beneath the table in which you are currently in.

In the Calculation Area, right-click the calculated field that will serve as the base measure (value), and then click

Create KPI.

In

Define target value, select from one of the following:

Select

Measure, and then select a target measure in the box.

Note: If there are no fields in the box, there are no calculated fields in the model.

You need to

create a measure.

Select

Absolute value, and then type a numerical value.

In

Define status thresholds, click and slide the low and high threshold values.

In

Select icon style, click an image type.

Click

Descriptions, and then type descriptions for KPI, Value, Status, and Target.

Edit a KPI

In the Calculation Area, right-click the measure that serves as the base measure (value) of the KPI, and then click

Edit KPI Settings.

Delete a KPI

In the Calculation Area, right-click the measure that serves as the base measure (value) of the KPI, and then click

Delete KPI.

Deleting a KPI does not delete the base measure or target measure (if one was defined).

More about KPIs

In business terminology, a KPI is a quantifiable measurement for gauging business objectives.

For example, the sales department of an organization might use a KPI to measure monthly gross profit against projected gross profit.

The accounting department might measure monthly expenditures against revenue to evaluate costs, and a human resources department might measure quarterly employee turnover.

Each is an example of a KPI.

Business professionals frequently use KPIs that are grouped together in a business scorecard to obtain a quick and accurate historical summary of business success or to identify trends.

A KPI includes:

Base value

A Base value is defined by a calculated field that resolves to a value.

This value, for example, can be created as an aggregate of sales or created to define profit for a given period.

Target value

A Target value is defined by a calculated field that resolves to a value, or by an absolute value.

For example, a calculated field could be used as a target value where the business managers of an organization want to compare how the sales department is tracking toward a given quota, where the budget calculated field would represent the target value.

An example where an absolute value would be used as a target value could be where the HR manager would like to evaluate each employee’s number of sick-leave days compared to the average, where the average number of sick-leave days represents the absolute value.

Status thresholds

A Status threshold is defined by the range between a low and high threshold.

The Status threshold displays with a graphic to help users easily determine the status of the Base value compared to the Target value.

Example

The sales manager at Adventure Works wants to create a PivotTable she can use to quickly display whether or not sales employees are meeting their sales quota for a given period (year).

For each sales employee, she wants the PivotTable to display the actual sales amount in dollars, the sales quota amount in dollars, and a simple graphic display showing the status of whether or not each sales employee is below, at, or above their sales quota.

She wants to be able to slice the data by year.

To do this, the sales manager chooses to add a Sales KPI to the AdventureWorks workbook.

The sales manager will then create a PivotTable with the fields (calculated fields and KPI) and slicers to analyze whether or not the sales force is meeting their quotas.

In Power Pivot, a calculated field on the SalesAmount column in the FactResellerSales table, which gives the actual sales amount in dollars for each sales employee is created.

This calculated field will define the Base value of the KPI.

The sales manager can select a column and click

AutoSum on the

Home tab or type a formula in the formula bar.

The Sales calculated field is created with the following formula:

Sales:=Sum(FactResellerSales[SalesAmount])

The SalesAmountQuota column in the FactSalesQuota table has a sales amount quota defined for each employee.

The values in this column will serve as the Target calculated field (value) in the KPI.

The SalesAmountQuota calculated field is created with the following formula:

Target SalesAmountQuota:=Sum(FactSalesQuota[SalesAmountQuota])

Note: There is a relationship between the EmployeeKey column in the FactSalesQuota table and the EmployeeKey in the DimEmployees table.

This relationship is necessary so that each sales employee in the DimEmployee table is represented in the FactSalesQuota table.

Now that calculated fields have been created to serve as the Base value and Target value of the KPI, the Sales calculated field is extended to a new Sales KPI.

In the Sales KPI, the Target SalesAmountQuota calculated field is defined as the Target value.

The Status threshold is defined as a range by percentage, the target of which is 100% meaning actual sales defined by the Sales calculated field met the quota amount defined in the Target SalesAmountQuota calculated field.

Low and High percentages are defined on the status bar, and a graphic type is selected.

Key Performance Indicators in Power Pivot

The sales manager can now create a PivotTable adding the KPI’s Base value, Target value, and Status to the Values field.

The Employees column is added to the RowLabel field, and the CalendarYear column is added as a Slicer.

The sales manager can now quickly view sales status for the sales dept., slice by year the actual sales amount, sales quota amount, and status for each sales employee.

She can analyze sales trends over years to determine whether or not she needs to adjust the sales quota for a sales employee.

6 KPI's Your Home Services Business Should Be Tracking

When you own a small business, it can be hard to know how to measure success and make sure you're primed to grow.

There are, however, tried-and-true KPIs to help you monitor the trajectory of your company and correct the course as you face new challenges.

Running a small business can be daunting and in markets as competitive as HVAC, electrical, garage door repair and plumbing, you need to know how to keep the finger on the pulse of your operation.

By zeroing in on several key metrics, you can assess where your company is succeeding, where it could be doing more, and what can be done to ensure your business thrives.

Here are the six KPIs we recommend:

1. Sales Revenue

Sales revenue is simply how much money is coming in from the sale of your services (and any products you may offer).

This is a foundational metric essential for any company to stay in business, hire staff, adjust inventory, and so on.

It’s also important to look for trends in your sales revenue.

Do you experience spikes or slow periods during certain seasons? Distinguishing and anticipating these trends can help you make long-term financial decisions and ensure longevity.

2. Gross Margin

Your gross margin is your sales revenue minus the cost of providing services, divided by sales revenue.

Gross margin is expressed as a percentage and can help you track the growth of your business.

This percentage represents the amount of every dollar from your sales revenue you retain as profit.

If the percentage is high, your efficiency is good.

If it is low, then look into increasing productivity.

Tracking expenses — and then properly applying to your bookkeeping every month —

is more complicated than it sounds.

Remember not to close out your month’s numbers until accurately assigning the expenses to the services provided over that time period.

Part of this includes tracking materials used from your inventory only when they are used for booked jobs (rather than calculating an incoming stocking order as one large expense for the month).

3. Monthly Profit/Loss

There is another number that needs to subtracted from your profit to determine your monthly profit (or loss): fixed and variable operation costs.

Fixed costs are regular costs you pay every month:

Rent

Utilities

Staff salaries

Advertising

Variable costs are unexpected costs that may fluctuate month-to-month, like gas usage, repair services at your office and so on.

Both fixed and variable costs every month are subtracted by your profits to calculate the money your company is bringing in.

If you find that your total costs are eating up a significant part of your profits, look into where you can start saving money every month.

A good rule of thumb is try and keep the total cost of operations (fixed + variable) at 30% or under.

4. Various Service Metrics

Do you know how long it usually takes for your techs to perform a certain install? How many service calls your techs can complete in one day? How often you sell a particular service in one month?

The revenue of your average ticket? The close rate of each of your techs? There are many different numbers you can derive from tracking tech performance and customer buying trends.

Track what you can, and over time you’ll find the the service metrics that are the most valuable for measuring your business’ success.

For Weldon Long, President of Wright Total Indoor Comfort, that metric was revenue per lead.

As Long told Contracting Business: “Revenue per lead is total volume divided by total number of leads, including cancelled leads, sold, lost, everything.

If a guy had 40 leads in a month and did a total of $100,000 in sales, you have $2,500 per lead.

That's the best metric we've found."

5. Customer Retention

How good is your company at inspiring loyalty among its customers? Returning customers can dramatically increase a home services company’s revenue.

Use customer service surveys or simple asks on the day of service to gain insight on how many customers keep coming back to your service (and, if possible, why).

Net Promoter Score, a tool used to gauge the loyalty of one’s customers, asks customers to answer a simple question on a scale of 1-10, “How likely are you to recommend (this company, this product, this experience, this representative) to your friends, family or business associates?” Customers who score between 0 and 6 are unlikely to give you repeat business while customers who score between 9 and 10 are likely to be promoters of your business or service.

If you find that your business is subsisting on many one-time, low-scoring customers, look at your customer services practices or implement retention campaigns (such as discounts) to bring customers back.

6. Advertising ROI

If you make the effort to invest in advertising — whether it be online, radio, print, TV or elsewhere — make sure you have some system in place to measure the return on your investment.

Customer surveys and CSR/tech inquiries to customers can help you understand where new customers and coming from and end costly advertising campaigns that may not be effective.

If you run various online ads (Facebook, Google PCP, Yelp paid listings, etc.), make sure that you get answers that specify which platform customers are using when they encounter your ads.

To calculate your advertising ROI, divide the returns (revenue) resulting from the campaign by the cost of the campaign.

KPI Examples

Performance management starts with figuring out what to measure.

Customer Service

Agent's full-time employees (FTEs) as percentage of total call center FTEs

Answering percentage (number of sales calls answered/total number of sales calls offered)

Average after-call work time

Average number of calls/ service request per handler

Average queue time of incoming phone calls

Cost per minute of handle time

Costs of operating call center/ service desk

Email backlog

Field service technician utilization

Hit rate (products sold compared to total received sales calls)

Inbound abandon rate

Inbound agent dialed calls

Inbound availability rate

Inbound average talk time

Inbound average wrap time

Inbound call center leads created

Inbound call center opportunities created

Inbound calls handled

Inbound calls handled per agent hour

Inbound service level

Number of complaints

Percentage of customer service requests answered in given timeframe

Percentage of calls transferred

Total calling time per day/week/month

Finance

Accounting costs

Accounts payable turnover

Accounts receivable collection period

Accounts receivable turnover

Actual expenses

Amount due (per customer)

Average customer receivable

Average monetary value of invoices outstanding

Average monetary value of overdue invoices

Average number of trackbacks per post

Budget variance for each key metric

Budgeted expenses

Capital expenditures

Cash conversion cycle (CCC)

Cash flow return on investments (CFROI)

Cost of goods sold (COGS)

Cash dividends paid

Cost per pay slip issued

Creditor days

Current receivables

Cumulative annual growth rate (CAGR)

Cycle time for expense reimbursements

Cycle time to process payroll

Cycle time to resolve an invoice error

Cycle time to resolve payroll errors

Days payable

Debtor days

Direct cost

Discounted cash flow

Earnings before interest and taxes (EBIT)

Earnings before interest, taxes, depreciation (EBITDA)

Economic value added (EVA)

Employee available time

Employee scheduled time

Employee work center loading

Enterprise value/ takeover value

Expense account credit transactions

Expense account debit transactions

Expense account transactions

Fixed costs

Gross profit

Gross profit margin

Indirect costs

Inventory turnover

Inventory value

Invoice processing costs

Internal rate of return (IRR)

Market share gain comparison percentage

Net change in cash

Net income

Net present value (NPV)

Number of invoices outstanding

Number of unapplied receipts

Number of past-due loans

Open receivables

Open receivables amount (per customer)

Operating leverage

Past-due receivables

Payables turnover

Payment errors as a percentage of total payroll disbursement

Percentage accuracy of financial reports

Percentage of bad debts against invoiced revenue

Percentage of electronic invoices

Percentage in dispute (per customer)

Percentage of invoices being queried

Percentage of invoices requiring special payment

Percentage of low-value invoices

Percentage of open receivables (per customer)

Percentage of payable invoices without purchase order

Percentage of service requests posted via web (self-help)

Perfect order measure

Quick ratio

Receivables

Receivables turnover

Return on capital employed (ROCE)

Sales growth

Share price

Systems cost of payroll process as a percentage of total payroll cost

Total payables

Total energy used per unit of production

Total receivables

Total sales

Unapplied receipts

Variable costs

Weighted days delinquent sales outstanding

Weighted days delinquent sales outstanding (per customer)

Weighted terms outstanding

Weighted terms outstanding (per customer)

Human Resources (HR)

Actual versus budgeted cost of hire

Annualized voluntary employee turnover rate

Annualized voluntary turnover rate

Average headcount of employees each human resources (HR) employee working is caring for

Average interviewing costs

Average length of placement in months for the manager

Average length of service of all current employees

Average length of service of all employees who have separated

Average months placement

Average number of training hours per employee

Average number of vacation days per employee

Average performance scores of departing employees

Average retirement age

Average salary

Average salary for all employees reporting to the selected manager

Average sourcing cost per hire

Average time employees are in same job/ function

Average time to competence

Average time to update employee records

Average training costs per employee

Compensation cost as a percentage of revenue

Contingent workers

Employee satisfaction with training

End placements

Female to male ratio

Full-time employees (FTEs) per human resources (HR) department FTE

Headcount of contingent workers for the manager

HR average years of service (incumbents)

HR average years of service (terminations)

HR department cost per FTE

HR headcount - Actual

HR headcount - Available

HR to employee staff ratio

Job vacancies as a percentage of all positions

New hire quality

Time to fill

Hiring manager satisfaction

Cost per hire

Staffing efficiency

Internal, external, and total headcount recruiting costs and ratios

Number of end placements made in the reporting period for the manager

Part-time employees as a percentage of total employees

Percentage of employees receiving regular performance reviews

Percentage of employees that are near or at max for their vacation balances

Percentage of HR budget spent on training

Percentage of new hire retention

Ratio of internal versus external training

Ratio of standard level wage to local minimum wage

Return on investment (ROI) of training

Total overtime hours as a percentage of all work hours

Training penetration rate (percentage of employees completing a course compared to all FTEs)

Workforce stability

Information Technology (IT)

Account create success

Account termination success

Active directory performance index

Alert-to-ticket ratio

Average data center availability

Call center PBX availability

Campus PBX availability

Customer connection effectiveness

Data center capacity consumed

Email client availability

Exchange server availability

Incidents from change

Internet proxy performance

Network availability - High availability sites

Network availability - Standard sites

Network manageability index

No problem found/duplicate tickets

Percentage of branch office backup success

Percentage of circuits exceeding target utilization

Percentage of IT managed servers patched at deadline

Percentage of production servers meeting software configuration standards

Percentage of security update restarts within maintenance window

Percentage successful remote access server (RAS) connections

Phone answer service level

Priority 1 and priority 2 network incidents meeting SLA

Product adoption status and compliance

Restore success rate

Server growth rate

Server manageability index

Service desk client satisfaction - Percentage dissatisfied

Service desk tier 1 resolution rate

Service desk time to escalate

Service desk time to resolve

Storage utility service availability

Storage utility utilization

Virtual machine provisioning interval

Virtual server utility availability

Web server availability

Marketing

Ad click-through ratio (CTR)

Average response rates of campaigns

Brand awareness percentage

Brand consideration

Brand credibility

Brand strength

Column inches of media coverage

Consumer awareness

Contact rate (number of contacts effectively contacted / number of contacts in the target list)

Cost per converted lead

Cost per lead

Cost per mille (CPM)

Delivery of materials

Effective reach

Gross rating point (GRP)

Growth sustainability rate of brand

Leads generated

Marketing budget awareness-demand ratio

Marketing budget ratio (MER)

Number of article placements in trade magazines

Number of client visits

Number of product focus groups conducted

Number of customer satisfaction surveys administered

Number of placements in trade magazines

Number of trade shows attended / participated in

Percentage of customers willing to promote your product/service

Q score (a way to measure the familiarity and appeal of a brand, etc.)

Response rate

Return on investment (ROI) of brand

Return on marketing investment (ROMI)

Revenue generation capabilities of brand

Staying in budget

Target rating point

Total cost of customer acquisition

Transaction value of brand

Website click-throughs

Website hits

Website leads generated

Sales

Actual calls

Actual sales value versus initial bid

Age of sales forecast

Average administrative time per sales person

Average deal size

Average number of activities (calls, meetings, etc.) to close a deal

Average price discount per product

Average price discount per sales person

Average revenue per product

Call quota

Closed sales

Closing ratio

Customer acquisitions costs as a percentage of sales value

Customer churn ratio

Customer loyalty

Customer purchase frequency

Customer satisfaction

Frequency of sales transactions

Gross margin per product

Gross margin per sales person

New sales person ramp-up time

Number of certified partners

Number of deals per partner

Number of sales orders by FTE

Number of sales people meeting their quota

Number of units sold per day/week/month/quarter/year

Partner churn ratio

Partner profit margin

Percentage of converted opportunities

Percentage of online sales revenue

Percentage of sales due to launched product/services

Percentage of sales representatives to achieve quota

Percentage of sales revenue via partner channel

Pipeline by sales stage

Qualified leads

Qualified opportunities

Revenue per sales person

Sales capacity

Sales cycle time

Sales per department

Sales person turnover

Sales quota

Time utilization

Unweighted sum of deal size in sales pipeline

Value of sales lost

Win/loss ratio percentage

Accommodation and Food Services

General

Average revenue per guest

Average revenue per table

Complaints per head

Complaints per order Labor cost per guest

Labor cost per table Minutes per table turn

Profit per table

Bar and cellar management

Average profit percentage on sales Carrying cost of stock Gross profit on sales

Sales and stocktaking discrepancies

Sales per head

Stock turnover

Stock value

Front of house and restaurant management

Front of house labor hours

Food, dessert, and beverage sales per head

Front of house labor percentage

Linen costs

Number of customers

Revenue per available seat hour (RevPASH)

Seating efficiency

Strike rate - Number of diners over number of occupying guests

Total sales per head - Total sales divided by the number of customers.

Kitchen management

Food cost percentage - Food cost over food sales

Food costs per head

Kitchen labor percentage - Kitchen labor cost over food sales

Kitchen labor hours - Over sales

Kitchen linen costs

Percentage of sales per selling items

Stock value

Total food costs

MANAGEMENT OF FINANCE AND ADMINISTRATION

Cash position at bank

Administration labor costs

Computer and technology efficiency (percentage of downtime, POS accuracy, staff equipment literacy rate)

Taxes owed

Return on investment

Sales and costs - Actual versus budget as a percentage

Stocktaking discrepancies per department

Total (short term) accounts due

Total accounts payable

SALES AND MARKETING PLUS FUNCTION MANAGEMENT

Booking forecast - Future x weeks / months, special holidays

Number of function inquiries, percentage of campaign cost against functions

Marketing and advertising costs and cost per response as ratio

Press mentions

Campaign response rate

Sales inquiry conversion rate - The number of inquiries that turn into actual sales

Sales per head (across all areas)

Repeat visits, especially by top 100 or 200 customers

Staffing

Average hourly pay

Average length of employment

Profit/markup on function labor charge-out (caterers)

Labor turnover (number of new staff in any one week or month)

Sick days taken (as a percentage of total available working days)

Total labor cost percentage

Total labor hours per each section

Wage cost percentage - Wage costs as a percentage of sales

Waste Management and Remediation Services

Electronics) Sub-sector indicators - For printed circuit board (PCB), semiconductor, and cathode ray tube (CRT) manufacture

Chemical emission rate per facility

Compliance with water license conditions

Cost per load

Demolition recovery index and new build recovery index

Discharge efficiency

Energy indicators

Facility saturation rate

Percentage of hazardous material over total waste

Percentage of reusable/recycled material

Percentage of sample failure

Percentage of total waste diverted from landfill and other disposal options

Percentage of waste recycled off site

Percentage of wastewater treatment works meeting license conditions

Percentage of waste reused off site

Percentage of waste reused on site

Pollution indicators (emissions to air, effluent, solid waste)

Potable water consumption

Renewable energy consumption

Segregation rate

Site level indicators of resource efficiency

Surface runoff efficiency

Total recycled content by material value

Transport time efficiency

Waste cost per carriageway or pipeline length

Waste cost per project as percentage

Waste cost per project footprint

Waste cost per square meter floor area

Waste generation (tonnage) per project

Waste generation (tonnage) per square meter/ foot

Waste generation (volume) per project

Waste generation (volume) per square meter/ foot

Wastewater discharge

Emissions to air

Acid rain, eutrophication, and smog precursors

Dust and particles

Greenhouse gases

Metal emissions to air

Ozone depleting substances

Volatile organic compounds

Emissions to water

Nutrients and organic pollutants

Metal emissions to water

Emissions to air

Acids and organic pollutants

Metal emissions to land

Pesticides and fertilizers

Radioactive waste

Waste (landfill, incinerated, and recycled)

Agriculture, Forestry, Fishing, and Huntin2 Industry

21-day weight per litter

Amount of trees planted versus actual planted by percentage

Average number of harvest per year

Carbon dioxide per square mile

Cost per wildfire

Customer satisfaction level (CSAT)

Domestic demands versus supply

Dust and particles per square mile

Establishment's occupancy

Establishment's rate

Export rate

Import rate

Increase or decrease in number of complaints over time

Increase or decrease in number of hunting applications over time

Industry employment source and turnover rate

Industry gross product

Industry revenue

Landslides caused by wildfires

Number of wildfires

Percentage of increase in rod license

Percentage of increase or decrease in fish count (in relation to ecological effects)

Percentage of hazards minimized within x hours of notification

Percentage of live birth (per each animal group)

Percentage of natural resources accessed

Percentage of natural resources sustained

Total wages

Wean per litter

Weight per litter at birth

Arts, Entertainment, and Recreation

INSTITUTIONAL KPIS

Album publication over total submission

Average ticket price per season

Cost per broadcast hour

Cost per performing night

Cost per production hour

Cost per viewer/ listener

Donation percentage of total revenue

Donation increase / decrease over time

Employer satisfaction rate

Employment rate

Gallery showing over total submission

Graduation rate

Increase/decrease number of performance nights per year

Market share

Net surplus percentage

Number of kindergarten through 12th grade school tours per year

Occupancy rate

Percentage of broadcast hours by genre

Percentage of national content (broadcasting organizations)

Percentage of overhead against total expenditure

Profit percentage

Ratio of amateur versus professional performers

Revenue

Special/guest appearance cost per revenue

Television show rating

Utilization rate (recording studio, concert hall, art studio)

Viewers/listeners for each medium as a percentage of total population

Personal KPIs

Number of awards

Number of gallery showings per year

Number of public appearances per year

Number of published recordings

Number of renowned awards (e.g., Billboard, Oscar, etc.)

Ratio of won competitions over participated

Construction

Number of accidents

Number of accidents per supplier

Actual working days versus available working days

Cash balance - Actual versus baseline

Change orders - Clients

Change orders - Project manager

Client satisfaction - Client-specified criteria

Client satisfaction product - Standard criteria

Client satisfaction service - Standard criteria

Cost for construction

Cost predictability - Construction

Cost predictability - Construction (client change orders)

Cost predictability; Construction (project leader change orders)

Cost predictability - Design

Cost predictability - Design and construction cost to rectify defects

Customer satisfaction level

Day to day project completion ratio - Actual versus baseline

Fatalities

Interest cover (company)

Labor cost - Actual versus baseline

Labor cost over project timeline

Liability ratio (over asset) on current versus completion comparison

Number of defects

Outstanding money (project)

Percentage of equipment downtime

Percentage of labor downtime

Percentage of backlogs over project timeline

Percentage of unapproved change orders

Productivity (company)

Profit margin - Actual versus baseline profit margin over project timeline

Profit predictability (project)

Profitability (company)

Quality issues at available for use

Quality issues at end of defect rectification period

Ratio of value added (company)

Repeat business (company)

Reportable accidents (including fatalities)

Reportable accidents (non-fatal)

Return on capital employed (company)

Return on investment (client)

Return on value added (company)

Time for construction

Time predictability - Construction

Time predictability - Construction (client change orders)

Time predictability - Construction (project leader change orders)

Time predictability - Design

Time predictability - Design and construction

Time taken to reach final account (project)

Time to rectify defects

Educational Services

Administrative expenses as a percentage of educational and general expenditures

Admission test scores for entering students

Annual student survey - Two-year comparison in five key areas

Attrition rate of online courses

Average course experience

Average daily attendance

Average daily participation percentages

Average endowment distribution by student

Average net academic cost and average percent discount

Average percentage consistently absent

Average student credit hours taught by tenure/ tenure track faculty by college

Average tenure or tenure track faculty salaries by college compared to peer benchmarks

Average undergraduate student credit load

Average student free application for federal student aid (FASFA) unmet financial need

Average graduating student debt

Choice into district - Number of students

Choice out of district - Number of students

Class attendance

Classroom and laboratory utilization

Comparison of most recent graduating high school classes to diversity of new 18-and 19-year-old students who enroll in the following fall term

Continuation rates of college students

Cost per graduate

Cost per meal (CPM)

Degrees awarded - Baccalaureate, masters, doctoral

Development expenditures as a percentage of total external income

Distance learning enrollment

Distance learning number of degree programs

Dollar value of restricted research expenditures

Dollar value of total external research grant applications and expenditures

Endowment value per student

Expenditures per student

Fewer students classified as needing special education services

Four-year graduation rate for community college transfer students with 30+ hours

Freshman retention rate by ethnic group and by financial aid category

Fund balance at x % of yearly expenditures

Graduate/ professional degrees in high demand fields

Home school students registered - Number of students

Increase of percentage of school-age students with disabilities participating in occupational education program

Increase of percentage of school-age students with disabilities receiving special education services in general class placements

Increase of percentage of preschool students with disabilities receiving special education services in settings that include nondisabled children

Increase of percentage of school-age students with disabilities receiving services in general education buildings

Institutional debt per student

Instructional expenses per student

International student load

International student headcount and percentage of FTE

Licensure exam pass rates

Licensure exam pass rates in program x

Master's-level five-year and doctoral ten-year graduation rate

Masters and doctoral graduates employed in state x compared to other state x graduates

National ranking of baccalaureate, masters, and doctoral degrees awarded to minority students

Nationally ranked programs

NCAA team sports athletics total wins

Non-instructional FTE per student FTSE, or non-instructional FTE to instructional FTE ratio

NSSE results in quality of student advising, entire educational experience, would attend again, overall satisfaction

Number of degrees awarded

Number of students per teacher

Number of total budgeted tenure/ tenure track faculty positions

Number of vocational degrees awarded

Percentage of academic staff with a doctorate

Percentage of full-time faculty who are women, are ethnic minorities, or have terminal degrees

Percentage of course requests satisfied by semester

Percentage of degree-seeking new transfers (of total enrollment)

Percentage of first year class in top 10% and top 25% of HS graduating class

Percentage of first year students requiring developmental education and successful completion percentage of developmental education

Percentage of graduating seniors from area high schools from most recent academic year who enroll in following fall term

Percentage of new students ages 18 to 19 who need developmental education based on their test scores

Percentage of tenure/tenure track faculty holding grants by college

Percentage of total positions endowed

Percentage of undergraduates receiving baccalaureate degrees with eight SCH or fewer above minimum requirement, number qualifying for state mandated rebate, and number requesting and receiving their rebate

Postdoctoral fellows

Program expenditures as a percentage of budgets Research rankings national and state Retention rates of students in vocational courses SCH taught by tenure/tenure track faculty vs. non-tenure/tenure track faculty by college

Six-year graduation rate and combined graduation/persistence rate

Student services expenditures per student FTSE

Students per faculty

Successful course completion

System-wide reduction in energy use over ten years

Technology transfer - new invention disclosures, patents issues, licenses and options executed, gross revenue from intellectual property

Time to a baccalaureate degree by area of study

Total budgeted endowed professorships and chairs

Total degree seeking new transfers

Total external gifts by alumni - Number and amount

Total external gifts by corporations - Number and amount

Total external gifts by foundations - Number and amount

Total external gifts by individuals - Number and amount

Total new transfer students

Total operating expenditures per student FTE

Total professorships and chairs positions filled

Total state appropriations per FTE student and tuition and fees per FTE student in constant dollars

Total state appropriations per FTE student compared to peers

Total stipend support for graduate students

Transportation costs per pupil

Tuition and mandatory fees compared to peers

Undergraduate classes with fewer than 30 students

Undergraduate degrees in high demand fields

Undergraduate financial aid awards

Undergraduates per professional academic advisor by college

Unrestricted reserves as percentage of operating budget

University students studying abroad headcount

Yellow bus on-time performance

Finance and Insurance

Finance

Accounts payable

Asset turnover rate

Average sum deposited in new deposit accounts

Average value of past due loans

Common stock equity

Cost per hour per lawyer (in-house)

Cycle time to perform periodic close

Debt-to-asset ratio

Direct costs

Earnings per share (EPS)

EBIT

EBITDA

Economic value added

Enterprise value/takeover value

Gross margin on managed assets

Interest expense

Interest on net worth

Invoicing processing costs

Labor and management cost

Labor and management earnings

Legal staff per size of revenue

Long-term debt

Marginal costs

Net interest margin

Net new money

Net profit

Net profit margin

Number of budget deviations

Number of past due loans

Operating income

Operating margin

Operating profit margin

Other current liabilities

Other noncurrent liabilities

Percentage of accuracy of periodic financial reports

Percentage of effectiveness in payables management

Percentage of budget deviation relative to total budget

Percentage of financial reports issued on time

Percentage of invoices under query

Percentage of legal budget spent outside

Preferred stock equity

Product turnover ratio

Profit

Profit loss due to theft

Profit margin

Profit per product

Rate of return on assets

Rate of return on equity

Return on assets

Return on investment (ROI)

Return to equity

Revenue per employee

Sales per share

Same store sales

Selling general and administrative (SG&A) expenses

Shares outstanding

Sharpe ratio

Short-term debt

Sortino ratio

Tier 1 capital

Total assets

Total current liabilities

Total equity

Total legal spending as a percentage of revenue

Total liabilities

Total of uninvested funds

Total quantity of new deposit accounts

Total sum deposited in new deposit accounts

Total value of past due loans

Variable costs

Insurance

Average insurance policy size

Claims

Combined cost and claims ratio

Combined ratio

Current premium versus loss

Earned premium

Expense ratio

Expenses

Exposure

Loss adjustment expenses (LAE)

Loss ratio

Number of days open of insurance claims

Number of new insurance policies

Previous premium versus loss

Underwriting speed of insurances

Written premium

Health Care and Social Assistance

Accounts receivable

Accounts payable and accrued expenses

Admissions in-patient

Average length of stay (ALOS)

Average length of stay (ALOS) for top ten diagnoses

Assets in current period

Assets in prior period

Average age of plant

Average age of workforce

Average daily and monthly census

Average hourly rate

Average length of stay

Average payment period (days)

Average time to fill positions

Backorder percentage

Bad debt as percentage of net revenue

Bottleneck areas

Break even

Capital expenditure growth rate

Case mix index

Cash and equivalents

Cash collected versus target

Cash on hand (days)

Communication effectiveness

Contract negotiation schedule

Cost per discharge

Current asset turnover

Current ratio

Days in accounts receivable

Debt service coverage ratio

Depredation funds

Depreciation rate

Discharge process time

Discharges in-patient

Discounts trends, revenue, and margin by payer class

Due to third parties

Education funds

Emergency visits outpatient

Encounters outpatient

Equity financing

Errors related to procedure/treatment or test

Events, number of events by type and department

Expenses per physician FTE

Fixed asset turnover

Free operating cash flow to assets

Free operating cash flow to revenue

FTE per occupied bed

FTEs per adjusted occupied bed

Growth rate on equity

Hazardous materials usage

Informed about delays

Inventory ratio

Investments at market value

Long-term investments

Maintained bed occupancy

Mean wait time in emergency department (ED) for hospital bed

Medication errors, number of errors per 1,000 treatments

Medication errors, number of errors per month/year

Month to date (MTD) bad debt

MTD cash collected

MTD revenue

Net assets

Net income to patient revenue

Net revenue

Non-operating gains

Number of new hires per day

Nurse turnover rate

Nurse vacancy rate

Nurses attention to needs

Operating revenues

Other liabilities

Outside labor as a percentage of total

Over or under consumption of service lines by payer types

Overtime costs

Paid time off costs at business unit level

Paid time off costs at department level

Patient accounts receivable

Patient care hours

Patient complaint rate

Patient satisfaction

Patient wait times, by process step

Patient/staff ratios

Patients who leave without being seen (by day, by time)

Percentage of capital expenses

Percentage of cash flow to total debt

Percentage of cash flow to total liabilities

Percentage of charitable revenue

Percentage of debt to capitalization

Percentage of fixed asset financing

Percentage of in-patient capitated revenue

Percentage of in-patient commercial revenue

Percentage of in-patient HMO revenue

Percentage of in-patient revenue

Percentage of in-patient self-pay revenue

Percentage of Medicaid revenue

Percentage of operating margin

Percentage of outpatient Medicare revenue

Percentage of outpatient revenue

Percentage of part-time FTEs of total FTEs

Percentage of voluntary staff turnover

Physician FTE

Physician productivity (relative value units)

Purchase order (PO) quantity ordered by department

Property, plant, and equipment

Readmission rates

Replacement viability

Reported income index

Reserve levels

Return on equity

Return to vendor

Revenue by contract type

Revenue per physician FTE

Risk-adjusted mortality

Salaries and benefits

Satisfaction with physical examination

Satisfaction with physician

Service line utilization and trends by payer type

Service provision

Short-term investments

Skill levels

Source of hires versus cost

Staff turnover

Staff turnover by job code

Staff turnover by location

Staffing cost trend

Staffing-related quality indicators

Supplies and services

Surgical cases in-patient

Surgical cases out-patient

Times interest earned

Total admissions

Total cash and investments

Total compensation per FTE

Total discharge

Total income

Total margin

Total operating expenses

Total paid time off of FTEs

Total PO dollar amount

Total revenue per FTE

Total salary per FTE

Total travel distance

Total turnover per manager

Total turnover per tenure

Total unrestricted funds

Turnover of clinical and non-clinical staff

Uncompensated care

Unit efficiency

Unrealized gains

Vacancy rate

Weekly payroll

Working capital absorption

Working capital for current accounting period

Information

Annual cost per reading

Average cost per article

Average cost per subscription

Average dollars per email sent or delivered

Average order size

Average quarter-hour audience

Average revenue per subscription

Average time spent listening per user (day/week/month/year)

Bounce rate

Click to open rate (number of unique clicks/ number of unique opens)

Click-through rate

Click-through rate (CTR)

Conversion rate

Conversion rate (number of actions/unique click-throughs)

Conversion rates

Cost per consumed (by viewers/listeners) hour

Cost per customer

Cost per lead, prospect, or referral

Cost per viewer/listener

Cost per visitor

Cost per action (CPA)

Cumulative audience sessions

Delivery rate (emails sent, bounces)

Gross ratings points

Life cycle cost per reading

Local content as a percentage of all content

Net subscribers (number of subscribers plus new subscribers) -(bounces + unsubscribes)

Number of broadcast hours per day/week/month/year

Number of or percentage of spam complaints

Number of orders, transactions, downloads, or actions

Open rate

Output per employee (unique first run broadcast hours by employee for each medium)

Pay per click (PPC)

Pay per lead (PPL)

Pay per sale (PPS)

Percentage of broadcast hours by genre (news/sports/entertainment, etc.)

Percentage of overhead (non-direct operating costs) against total expenditure

Percentage of orders, transactions, downloads, or actions of emails sent or delivered

Percentage unique clicks on a specific recurring Iink(s)

Referral rate ("send-to-a-friend")

Site stickiness (number of pages visited per visit)

Subscriber retention (number of subscribers, bounces, unsubscribes/number of subscribers)

Total cost per subscription

Total listener hours (day/week/month/year)

Total revenue

Total revenue per subscription

Unique visitors (total number of unique visitors per day/week/month)

Unsubscribe rate

Utilization of production resources

Value per visitor

Viewers/listeners for each medium as a percentage of total population

Website actions (number of visits to a specific web page or pages)

Website traffic (total page impressions per day/week/month)

Management of Companies and Enterprises

Capital ratio

Cash position by currency

Cash-to-assets ratio

Cash-to-liabilities ratio

Cash-to-working capital ratio

Cash utilization

Change in residual risk levels

Comparative revenues across offices/subsidiaries/departments

Consolidated payments

Consolidated profits

Consolidated receivables

Consolidated revenues

Consolidated settlements

Cost of equity

Cost to hire management talent

Cost-to-income ratio - By business

Cost-to-income ratio - Consolidated

Days in accounts payable

Days in accounts receivable

Earnings per share

Economic profit

Effectiveness of the risk management practices that are controlling material risks

Employee engagement (as measured through survey participation)

Employee movement (such as time in position, transfers, and promotions)

External funds under management

Holding company cash flow

Internal rare of return on new business information technology (IT) spending per employee

Level of inherent risk

Long-term debt

Net profit growth

New business profit

Operating profit on long-term investments

Profit diversification

Return on equity

Revenue mix

Short-term debt

Time to hire management talent

Total cash deposits

Manufacturing

Asset utilization

Availability

Avoided cost

Capacity utilization

Comparative analytics for products, plants, divisions, companies

Compliance rates (for government regulations, etc.)

Customer complaints

Customer satisfaction

Cycle time

Demand forecasting

Faults detected prior to failure

First aid visits

First time through

Forecasts of production quantities, etc.

Increase/decrease in plant downtime

Industry benchmark performance

Integration capabilities

Interaction level Inventory

Job, product costing

Labor as a percentage of cost

Labor usage, costs-direct and indirect

Machine modules reuse

Maintenance cost per unit

Manufacturing cost per unit

Material costing, usage

Mean time between failure (MTBF)

Mean time to repair

Number of production assignments completed in time

On-time orders

On-time shipping

Open orders

Overall equipment effectiveness

Overall production efficiency of a department, plant, or division

Overtime as a percentage of total hours

Percentage decrease in inventory carrying costs

Percentage decrease in production-to-market lead-time

Percentage decrease in scrap and rework costs

Percentage decrease in standard production hours

Percentage increase in productivity

Percentage increase in revenues

Percentage material cost reduction

Percentage reduction in defect rates

Percentage reduction in downtime

Percentage reduction in inventory levels

Percentage reduction in manufacturing lead times

Percentage savings in costs

Percentage savings in inventory costs

Percentage savings in labor costs

Percentage savings in transportation costs

Planned work to total work ratio

Predictive maintenance monitoring (maintenance events per cycle)

Process capability

Productivity

Quality improvement (first-pass yield)

Quality tracking-six sigma

Reduced time to productivity

Reduction in penalties

Savings in inventory carrying costs

Scheduled production

Spend analytics

Storehouse stock effectiveness

Supplier trending

Time from order to shipment

Time on floor to be packed

Unplanned capacity expenditure

Unused capacity expenditures

Utilization

Waste ration reduction

Work-in-process (WIP)

Mining

Average bucket weight

Average fuel use per machine

Average loading time

Average number of dumps per hour/day/week/month

Average number of loads per hour/day/week/month

Average payload

Average swing time

Cash operating costs per barrel of oil equivalent (BOE)

Change time (time between cycles)

Cycle distance

Cycle time

Degree of purity and physical characteristics

Dilution of ore

Dump time

Efficiency of metallurgical recovery

Empty stop time

Empty travel distance

Empty travel time

Exploration costs

Finding and development costs

Flitch

Fuel (e.g. , gallons/hour)

Gross refining margin

Incident rate (accidents, etc.) per x hours

Lifting costs

Loaded stop time

Loaded travel distance

Loaded travel time

Loading time

Lost time incident frequency rate

Number of equipment failures per day/week/month/year)

Number of holes drilled per day/week/month/year

Oil reserves

Payload

Payload correction (difference between raw and corrected payload)

Percent (metal, etc.) in ore

Percentage uptime (of equipment, plant, etc.)

Product into shed

Production cost per barrel

Production rate-bank cubic meter (BCM)/ hour (cubic meters of material moved per hour)

Raw material substitution rate (percentage)

Raw payload

Reserve and resource replacement (percentage)

Tons of ore feed

Tons per hour

Tons per load

Total minutes lost per shift due to breaks

Unit variable costs

Utilization

Waste per ton

Waste recycling (e.g., tons per time unit)

Waste volume

Other Services (except public administration)

Average employee utilization

Average equipment utilization

Average number of days required to repair the item

Average number of no· shows per week/month

Average number of training hours per employee

Average repair cost

Average repair time

Average revenue per service delivered

Cash collected

Collections

Average training cost per employee

Client retention rate

Customer turnover rate

Daily goals

Employee turnover rate

Gross profit on pans/material sold

Idle time

Material cost per service hour sold

Mean service request completion time

Time to dose distribution (by time buckets)

Net profit as a percentage of labor sold

Number of apprentices and organized members certified

Number of apprentices and organized members needed to meet requirements

Number of open service requests

Number of prospective clients converted to clients

Number of service requests resolved during the period

Number of training courses conducted per month/quarter/year

Service level details

Percentage of members participating in approved programs

Percentage of total members participating in meetings

Period service renewal rate

Period service renewals booked value/period service renewals value

Period service renewals value

Repair order mean time to repair

Repair order past due percentage

Sales per employee

Sales per estimator

Sales per production square foot

Sales per production technician

Service booked to renewal ratio

Service contracts activated new business value

Service Contracts activated renewals value

Service contracts expired value

Service contracts terminated billed value

Service contracts terminated remaining value

Service department throughput (per day/week/month)

Service level

Service renewal past due percentage

Service renewals booked value

Service renewals forecast

Service renewals uplift

Service request backlog

Service request closed activity

Service request escalated backlog percentage

Service request reopened activity

Service request unassigned backlog percentage

Target membership growth

Total pans/material cost as a percentage of total sales

Unresolved escalated backlog percentage

Unresolved service request backlog

Unresolved unassigned backlog percentage

Weekly team targets

Professional, Scientific, and Technical Services

Annual billable utilization percentage

Availability

Availability (excluding planned downtime)

Average percentage of CPU utilization

Average percentage of memory utilization

Average hourly fee

Average number of virtual images per administrator

Cost of managing processes

Cost of service delivery

Deviation of planned budget for SLA

Downtime

Mean time to repair (MTTR)

Mean time between failure (MTBF)

Number of defects found over period of time

Number of outstanding actions of last SLA review

Percentage of application development work outsourced

Percentage of bugs found in-house

Percentage of consultants generating revenue

Percentage of consulting hours that generate revenue

Percentage of email spam messages stopped/detected

Percentage of outage due to changes (planned unavailability)

Percentage of outage due to incidents (unplanned unavailability)

Percentage of service requests resolved within an agreed-on period of time

Percentage of systems covered by antivirus/antispyware software

Percentage of systems with latest antivirus/antispyware signatures

Percentage of time lost redeveloping applications as a result of source code loss

Percentage of time sheets in need of correction/validation

Percentage of unit tests covering software code

Percentage of user requested features

Profit per project

Quality assurance personnel as percentage of the number of application developers

Software development quality

System usability scale

Time ratio for design to development work

Time-to-market of changes to existing products/services

Total service delivery penalties paid

Unit costs of IT services

Workforce turnover rate

Public Administration

Economic Development

Amount of new retail square footage

Average number of business days before reported graffiti is removed

Cost per animal sterilized

Cost per person trained in workforce development

Cost per sheltered animal

Cost per youth placed in summer youth employment jobs

Development of county-wide infrastructure, land supply, and affordable housing plan within one year, plan implementation and schedule adherence thereafter

Dropout rate of high school students

Health and human services

Housing affordability index/percentage of households that can afford a median-priced home

Net loss of agricultural or environmentally sensitive areas

Number of affordable mortgages financed for eligible low and moderate income families

Number of childcare facilities in areas of need

Number of childcare facilities with national accreditation

Number of economic development inquiries received

Number of emerging technology projects

Number of existing and startup businesses and agencies trained by the city or county per year that remain in business after two years

Number of jobs created in the community from economic and community development projects

Number of loans to low and moderate income persons closed per year

Number of low-income infants, toddlers, and preschoolers participating in early childhood development services (versus waiting list)

Number of new assisted living units in public housing within two years

Number of new businesses related to incentives/coordinated efforts to promote growth in targeted industries

Number of new incubated businesses that survive at least two years

Number of special projects completed

Number of successful placements of training program participants in employment within three years

Number of volunteer hours

Number of youth participating in after-school / gap-time programming

Number of youths participating in employment and entrepreneurship programs within two years

Per capita income

Percentage annual increase in new dollars generated for economic development programs

Percentage increase in graduation rare

Percentage of businesses trained and subsequently receiving funding within two years

Percentage of children with insurance

Percentage of people with disabilities satisfied or very satisfied with service access within three years

Percentage of residents satisfied with community involvement process with economic development

Percentage of residents with increased access to primary and specialty medical care

Percentage of sheltered animals adopted

Percentage of youth with improved academic performance

Percentage increase in the number of affordable and special needs housing

Percentage of businesses satisfied or very satisfied with the city/county's business processes

Percentage of customers of the health and human services area satisfied or very satisfied with service delivery and customer care

Percentage of participants who report they learned something that will help them start a business

Percentage of survey respondents earning less than $25,000 per year that rate the city/county's health and human services as good or very good

Percentage of survey respondents that agree the city or county government effectively develops low-income/poor areas

Percentage of users of health and human services satisfied or very satisfied with transit access to health care

Reduced percentage rate of uninsured in the city/county

Sick leave hours used per 1,000 hours

Total infant mortality rate per 1,000 live births

Total mortality rate (all causes) per 100,000

Unemployment rateNeighborhood and Unincorporated Area Municipal Services

Cost per document released

Net loss of agricultural designated lands outside the urban development boundary (UDB) or environmentally sensitive lands

Number of infill development and infill housing units and infill redevelopment projects per year (completed)

Number of renters assisted

Percentage of lease payments that will be on time

Percentage of tree canopy increase

Percentage of general/nuisance complaints responded to within 48 hours

Percentage of nuisance incidents remediated within predefined timeframes

Percentage of residents and businesses aware of critical knowledge factors of code compliance

Percentage of residents satisfied with information delivery systems

Percentage of roadways and rights-of-way cleaned and well maintained

Percentage of survey respondents that agree the city or county employees that helped them went the extra mile to get their issue heard and resolved

Percentage of survey respondents that rate flooding as a minor or major problem in their neighborhood

Percentage of survey respondents that rate the development and land use/zoning in their neighborhood as good or very good

Percentage of survey respondents that rate the drinking water quality and sewer service as good or very good

Percentage of survey respondents that rate the quality of roadways and road signs in city or county as good or very good

Percentage of survey respondents that were satisfied with their last contact with city or county personnel

Secret shopper rating for employee customer service

Total square feet of facilitiesPublic Safety

Average fire rescue response time from time dispatch receives life-threatening call from 911 and/ or percentage of total fire calls with a response time under eight minutes from call entry to arrival and/or emergency services average response time from public safety answering point (PSAP) to arrival

Cost per park safety enforcement action on park land

Development and implementation of a comprehensive plan for homeland security

Development of a comprehensive plan for homeland security

Increase in number of licensed pets over next three years

Increase number of public emergency shelters by 10% in three years

Number of abandoned vehicles investigated

Number of collisions related to pursuits

Number of first responders trained and equipped for an emergency event

Number of patrol hours in neighborhoods

Number of pedestrian/bicycle collisions per 100,000 population

Number of requests for special operations support

Number of service call responses annually

Percentage increase in number of volunteers over the next three years

Percentage increase in use of non-lethal technology over next three years

Percentage of citizens that state they feel safe in parks and recreation facilities

Percentage reduction in drug-related incidents

Percentage reduction in juvenile crime rates

Percentage reduction in non-emergency calls into the 911 system

Percentage of survey respondents who generally find police officers and traffic enforcement officers to be friendly and approachable safety services

Percentage of survey respondents that rate crime in their neighborhood as a minor or major problem

Percentage reduction in property loss rate

Police emergency average response time (minutes)

Rate of reinstitutionalization of offenders processed through the Juvenile Evaluation Center

Rate of traffic fatalities per 100,000 populationRecreation and Culture

Average cost per daily servicing acre

Average safety rating for pools